- 1M

- 3M

- 6M

- 1YR

- 3YR

- 5YR

- 10YR

- Since Inception

Performance

Monthly SIP of ₹ for

Total investment ₹36,000

| Total Value | Gain | Return % | |

|---|---|---|---|

| Bank FD | 39,824 |

3,824 |

6.5% |

| Gold | 40,770 |

4,770 |

8.00% |

Fund Information

-

180.66 Cr.

-

Growth

-

1.58%

-

Fund Of Funds- Overseas - Equity Fund

-

Nifty 50 Arbitrage Index

-

07 Aug 2013

-

Edelweiss Mutual Funds know more

Fund Managed By

Return Comparison

| Fund Name | 1 Month | 3 Months | 6 Months | 1 Year | 2 Years | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|---|---|---|

| Category Best | 17.87% | 49.16% | 87.64% | 107.66% | 67.31% | 49.03% | 22.90% | 17.62% |

| Category Average | 2.58% | 9.70% | 32.58% | 20.84% | 25.14% | 20.54% | 12.47% | 10.18% |

| Edelweiss US Value Equity Offshore Fund | 0.98% | 5.37% | 23.36% | 10.60% | 18.76% | - | - | - |

| DSP World Gold Fund Of Fund | 17.47% | 49.16% | 87.64% | 107.66% | - | - | - | - |

| Motilal Oswal Nasdaq 100 Fund Of Fund | 17.87% | 26.04% | 46.92% | 47.06% | 40.84% | 38.47% | 22.90% | - |

| Edelweiss US Technology Equity Fund Of Fund | 8.50% | 14.99% | 62.96% | 41.52% | 39.31% | - | - | - |

| DSP Global Innovation Fund Of Fund | 7.34% | 14.48% | 47.56% | 26.22% | - | - | - | - |

| Invesco India - Invesco Global Consumer Trends Fund Of Fund | 11.27% | 26.85% | 74.12% | 63.06% | 42.52% | - | - | - |

Fund Portfolio Details

Equity 0.00%

Debt 0.00%

Others 100.00%

Portfolio Holdings shown is as of 31 Jul 2025

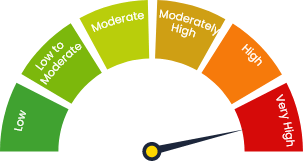

Riskometer

Investors understand that their

principal

will be at Very High risk