- 1M

- 3M

- 6M

- 1YR

- 3YR

- 5YR

- 10YR

- Since Inception

Performance

Monthly SIP of ₹ for

Below table shows comparison of HDFC Hybrid Equity Fund with respect to the investments in Fixed Deposit and Gold for the

Total investment of

₹36,000 over the period of 3 years.

| Total Value | Gain | Return % | |

|---|---|---|---|

| This Fund | 40,459 |

4,459 |

7.71% |

| Bank FD | 39,824 |

3,824 |

6.5% |

| Gold | 40,770 |

4,770 |

8.00% |

Fund Information

-

As of 31 Dec 2025, fund size of HDFC Hybrid Equity Fund is

24,684.07 Cr. -

HDFC Hybrid Equity Fund shown here is of

Growthplan.

-

The Total Expense Ratio (TER) of the fund is

1.68%. The Total Expense Ratio (TER) is a measure that represents the total costs associated with managing and operating a mutual fund as a percentage of its average Assets under Management (AUM). It provides an insight into the overall expenses they will incur by investing in the fund.

-

HDFC Hybrid Equity Fund is an

Hybridoriented mutual fund in the

- Aggressive Fundcategory.

-

Nifty 50 Arbitrage Index

is the benchmark for HDFC Hybrid Equity Fund. A benchmark for a mutual fund serves as a standard for performance comparison, helping investors assess how well the fund is meeting its objectives and how it fares against relevant market indicators. Investors often compare the fund's performance with the benchmark as well as its peers.

-

The inception date of a mutual fund refers to the date when the fund was first established and began operations. It is the starting point from which the fund's performance, returns, and other key metrics are calculated. The fund was started on

01 Apr 2005as at present it is 21 years old fund.

-

Name of the AMC is

HDFC Mutual Fund.

Click here to

know moreabout HDFC Mutual Fund.

Fund Managed By

Fund managers make investment decisions, optimizing returns and managing risks for portfolios. Responsibilities include market analysis, performance monitoring. HDFC Hybrid Equity Fund managed by following fund manager(s);

-

FM 1 - Mr. Srinivasan Ramamurthy

Fund ManagerClick here to

view all fundsmanaged by FM 1 - Mr. Srinivasan Ramamurthy

-

FM 2 - Mr. Dhruv Muchhal

Fund ManagerClick here to

view all fundsmanaged by FM 2 - Mr. Dhruv Muchhal

-

FM 3 - Mr. Anupam Joshi

Fund ManagerClick here to

view all fundsmanaged by FM 3 - Mr. Anupam Joshi

How does the

Return Comparison of the HDFC Hybrid Equity Fund fare against peer funds in the Aggressive fund category?

Peer fund returns can vary based on the collaborative nature and specific strategies employed by fund managers of these funds listed in below table, often showcasing different risk-return profiles compared to strategy adopted by HDFC Hybrid Equity Fund. Below table demonstrate the returns generated by some peer funds and compare tho this fund and average return generate by the Hybrid, Aggressive fund category these peer funds belongs to.

| Fund Name | 1 Month | 3 Months | 6 Months | 1 Year | 2 Years | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|---|---|---|

| Category Best | 5.64% | 3.53% | 6.77% | 17.96% | 12.09% | 18.14% | 18.78% | 17.23% |

| Category Average | 2.22% | -0.81% | 1.17% | 11.68% | 8.29% | 14.06% | 12.56% | 13.23% |

| HDFC Hybrid Equity Fund | 1.83% | -1.78% | 0.61% | 9.90% | 6.84% | 11.90% | 11.45% | 13.24% |

| ICICI Prudential Equity & Debt Fund | 2.69% | -0.09% | 3.03% | 15.68% | 11.07% | - | - | - |

| JM Aggressive Hybrid Fund | 1.70% | -3.05% | -2.23% | 5.31% | 4.46% | - | - | - |

| Mahindra Manulife Aggressive Hybrid Fund | 1.35% | -1.41% | 0.50% | 12.14% | 10.05% | 17.04% | 14.43% | - |

| Edelweiss Value Opportunities Fund | 2.68% | -0.63% | 0.91% | 11.82% | 9.36% | 16.88% | 14.73% | 13.80% |

| Edelweiss Aggressive Hybrid Fund | 2.67% | -0.63% | 0.90% | 11.82% | 9.35% | 16.84% | 14.66% | 13.76% |

Fund Portfolio Details

Portfolio details of a fund generally refer to a comprehensive breakdown of the investments held within a specific investment vehicle, such as a mutual fund or exchange-traded fund (ETF). Portfolio details of HDFC Hybrid Equity Fund are shown below;

Equity 69.92%

Debt 25.61%

Others 4.47%

Portfolio Holdings shown is as of 31 Dec 2025

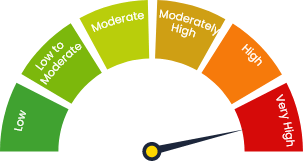

Riskometer

Investors understand that their

principal

will be at Very High risk