- 1M

- 3M

- 6M

- 1YR

- 3YR

- 5YR

- 10YR

- Since Inception

Performance

Monthly SIP of ₹ for

Total investment ₹36,000

| Total Value | Gain | Return % | |

|---|---|---|---|

| This Fund | 43,520 |

7,520 |

12.71% |

| Bank FD | 39,824 |

3,824 |

6.5% |

| Gold | 40,770 |

4,770 |

8.00% |

Fund Information

-

135.71 Cr.

-

Growth

-

2.38%

-

Equity- Sectoral Fund

-

Nifty India Consumption TRI

-

13 Nov 2018

-

Mahindra Manulife Mutual Fund know more

Fund Managed By

Return Comparison

| Fund Name | 1 Month | 3 Months | 6 Months | 1 Year | 2 Years | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|---|---|---|

| Category Best | 6.11% | 21.22% | 22.10% | 33.42% | 30.05% | 31.97% | 35.85% | 17.59% |

| Category Average | -3.38% | 3.13% | 3.20% | 1.31% | 14.85% | 16.17% | 21.43% | 12.61% |

| Mahindra Manulife Rural Bharat & Consumption Yojana | -1.34% | 3.13% | 1.41% | -4.72% | 15.35% | 15.00% | 18.72% | - |

| SBI PSU Fund | -4.73% | 3.48% | 7.10% | -7.64% | 29.94% | 31.97% | 29.79% | 11.91% |

| Invesco India PSU Equity Fund | -7.41% | 5.19% | 10.11% | -8.75% | 29.17% | 31.30% | 27.52% | 15.15% |

| HDFC Infrastructure Fund | -3.21% | 6.15% | 7.87% | -2.17% | 24.45% | 29.77% | 34.05% | 10.43% |

| Franklin India Opportunities Fund | -2.90% | 4.94% | 3.87% | 1.02% | 29.15% | 29.59% | 28.80% | 15.27% |

| ICICI Prudential Infrastructure Fund | -4.54% | 6.19% | 7.62% | 0.64% | 25.66% | 29.44% | 35.85% | 15.71% |

Fund Portfolio Details

Equity 93.56%

Debt 0.00%

Others 6.44%

Top Equity Holdings

| Name of the Equity | Holding Percentage |

|---|---|

| ITC LTD. | 5.85% |

| BHARTI AIRTEL LTD. | 5.36% |

| HINDUSTAN UNILEVER LTD. | 4.97% |

| MAHINDRA & MAHINDRA LTD. | 4.67% |

| Zomato Ltd | 3.63% |

| Others | 75.52% |

Allocation by Sector

| Name of the Sector | Holding Percentage |

|---|---|

| Consumer Staples | 31.86% |

| Fast Moving Consumer Goods | 30.99% |

| Automobile | 20.75% |

| Consumer Services | 18.68% |

| Automobile and Auto Components | 14.87% |

| Others | -17.15% |

Portfolio Holdings shown is as of 28 Feb 2025

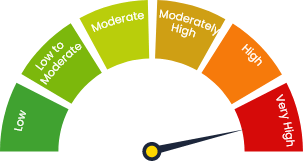

Riskometer

Investors understand that their

principal

will be at Very High risk