- 1M

- 3M

- 6M

- 1YR

- 3YR

- 5YR

- 10YR

- Since Inception

Performance

Monthly SIP of ₹ for

Below table shows comparison of ITI Arbitrage Fund with respect to the investments in Fixed Deposit and Gold for the

Total investment of

₹36,000 over the period of 3 years.

| Total Value | Gain | Return % | |

|---|---|---|---|

| Bank FD | 39,824 |

3,824 |

6.5% |

| Gold | 40,770 |

4,770 |

8.00% |

Fund Information

-

As of 31 Dec 2025, fund size of ITI Arbitrage Fund is

47.01 Cr. -

ITI Arbitrage Fund shown here is of

Growthplan.

-

The Total Expense Ratio (TER) of the fund is

0.93%. The Total Expense Ratio (TER) is a measure that represents the total costs associated with managing and operating a mutual fund as a percentage of its average Assets under Management (AUM). It provides an insight into the overall expenses they will incur by investing in the fund.

-

ITI Arbitrage Fund is an

Hybridoriented mutual fund in the

- Arbitrage Fundcategory.

-

Nifty 50 Arbitrage Index

is the benchmark for ITI Arbitrage Fund. A benchmark for a mutual fund serves as a standard for performance comparison, helping investors assess how well the fund is meeting its objectives and how it fares against relevant market indicators. Investors often compare the fund's performance with the benchmark as well as its peers.

-

The inception date of a mutual fund refers to the date when the fund was first established and began operations. It is the starting point from which the fund's performance, returns, and other key metrics are calculated. The fund was started on

05 Sep 2019as at present it is 7 years old fund.

-

Name of the AMC is

ITI Mutual Fund.

Click here to

know moreabout ITI Mutual Fund.

Fund Managed By

Fund managers make investment decisions, optimizing returns and managing risks for portfolios. Responsibilities include market analysis, performance monitoring. ITI Arbitrage Fund managed by following fund manager(s);

-

-

Mr. Vikas Nathani and Mr. Rohan Korde

Fund ManagerClick here to

view all fundsmanaged by Mr. Vikas Nathani and Mr. Rohan Korde

How does the

Return Comparison of the ITI Arbitrage Fund fare against peer funds in the Arbitrage fund category?

Peer fund returns can vary based on the collaborative nature and specific strategies employed by fund managers of these funds listed in below table, often showcasing different risk-return profiles compared to strategy adopted by ITI Arbitrage Fund. Below table demonstrate the returns generated by some peer funds and compare tho this fund and average return generate by the Hybrid, Arbitrage fund category these peer funds belongs to.

| Fund Name | 1 Month | 3 Months | 6 Months | 1 Year | 2 Years | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|---|---|---|

| Category Best | 0.70% | 1.86% | 3.39% | 6.81% | 7.46% | 8.03% | 8.47% | 7.93% |

| Category Average | 0.51% | 1.49% | 2.77% | 5.63% | 6.60% | 6.86% | 5.86% | 5.85% |

| ITI Arbitrage Fund | 0.51% | 1.66% | 2.92% | 6.39% | 6.70% | - | - | - |

| SBI Arbitrage Opportunities Fund | 0.52% | 1.58% | 2.92% | 6.45% | 6.82% | - | - | - |

| Invesco India Arbitrage Fund | 0.50% | 1.61% | 2.97% | 6.37% | 6.80% | - | - | - |

| ICICI Prudential Equity Arbitrage Fund | 0.53% | 1.61% | 2.93% | 6.39% | 6.82% | - | - | - |

| Tata Arbitrage Fund | 0.49% | 1.61% | 2.89% | 6.36% | 6.72% | - | - | - |

| Bandhan Arbitrage Fund | 0.50% | 1.50% | 2.79% | 6.10% | 6.63% | - | - | - |

Fund Portfolio Details

Portfolio details of a fund generally refer to a comprehensive breakdown of the investments held within a specific investment vehicle, such as a mutual fund or exchange-traded fund (ETF). Portfolio details of ITI Arbitrage Fund are shown below;

Equity 70.48%

Debt 0.00%

Others -41.27%

Portfolio Holdings shown is as of 31 Dec 2025

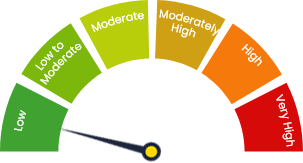

Riskometer

Investors understand that their

principal

will be at Low risk